This is a piece of news with little popularity during the transfer period of the draft, but it may become a symbol affecting the development of NBA and North American sports in the next decade or two.

Qatar Investment Authority (hereinafter referred to as QIA) officially took a stake in Washington Wizards to acquire 5% equity shares of Monumental Sports & Entertainment (hereinafter referred to as MSE), the parent company of Wizards, it became the first sovereign fund to invest in the mainstream League of the United States.

It is understood that the investment amount of QIA is about 4 billion (for the convenience of reading, the monetary unit of this article is US dollars), and the assets owned by MSE include not only Wizards, but also the Washington capital team (NHL), mystery Team (WNBA), First Capital stadium and sports media company MSN (with NBC Sports Washington Channel).

In recent years, it is not new for private equity or sovereign funds to enter the sports track, but QIA’s stake in NBA is quite interesting. You know, not long ago, NBA president Xiao Hua talked about the double-edged sword effect of “Middle East investment” on sports events in an interview. Of course, he is not talking about Qatar, but Saudi Arabia, which may be one of Qatar’s biggest competitors in the Middle East, and Saudi Arabia’s sovereign Fund (PIF) recent high-profile activities in the United States: Merging the two major golf events of PGA and LIV.

Xiao Hua’s comments were very cautious. He first indicated that NBA did not get any investment intention from Saudi Arabia. In addition, he also tried his best to dilute the criticism from the outside world and the contradiction stirred up by the political situation in the United States: “Saudi investment in sports always attracts too much attention, but this is not a big problem…… They have always invested in our largest enterprise group in the United States, including some familiar brands…… I am think that this is a double-edged sword effect.”

“I know someone has dismissed it as sports whitening (sportswashing). It will be known after watching last year’s World Cup. Therefore, Qatar has become the target of public criticism. This made people understand these countries and the something happening in the world, and the media played an important role in it, “Xiao Hua said.

“In terms of NBA alone, we have been on the road of globalization. I think now everyone is a little too ignoring the role of creating common ties for sports. Our finals are broadcast live all over the world, and there are countless basketball fans around the world. Basketball is definitely a good opportunity to promote unity.”

Xiao Hua and NBA officials have repeatedly stated that Qi will not participate in any Wizard operation, and it is impossible for any fund investing in NBA to get such authority in the future. “We hope to bring this game to a place that has never been touched, the Middle East is one of them.” Xiao Hua said.

However, some of the public opinions that PGA suffered were in the front, and NBA had already been condemned for playing preseason in UAE. The introduction of Qatar capital must bear some scrutiny.

In fact, the changes in the rules that allow the fund to invest and the review of QIA’s stake in wizards can only be passed by the vote of 30 team owners.

It is said that NBA is a business with steady profits and no compensation. Why do bosses distribute this good business to “outsiders”-or outsiders whose value positions are out of place, the doorway is not simple.

Since the new relay contract came into effect in 2016, NBA bosses have deeply realized the so-called “Troubles of the rich”. On the one hand, the market value of the team has risen, but on the other hand, the difficulty of equity flow is also increasing. To become an NBA boss, individuals must hold a large amount of capital and pay most (even all) of the equity in cash, which basically cannot rely on leverage.

In order to broaden the overall flow pool of small shareholders, bring more growth capital to shareholders and realize more efficiently, Xiao Hua sent a memorandum to the bosses of various teams at the end of 2019, suggesting that private equity investment be approved. By the next year, the board of directors voted to pass the resolution, making NBA the first mainstream alliance in the United States to allow private equity investment. After that, MHL, MLB and SLS all followed suit.

American Capital is eating professional clubs overseas, but domestic sports circles are very conservative to foreign investment. NFL has not opened private equity fund access so far. NBA is a pioneer, which is also a change in the operation direction after Xiao Hua succeeded Stern.

The rules introduced by NBA at that time required that the equity acquired by the shareholder should not exceed 20%; At the same time, the shareholding ratio of institutional investors of any team should not exceed 30%. By 2022, NBA relaxed restrictions again, allowing pension funds, university funds, endowment funds, family financial offices and sovereign wealth funds to take shares.

In the past two years, Dyal Homecourt and Arctos Sports Partners, which were approved by NBA, quickly raised money to invest in multiple teams, including warriors, kings, Sun, Eagles, jazz and 76 people, spurs 20% of the shares were also acquired by Sixth Street, an investment bank.

Naturally, these investors have to go through strict examination. For example, Dyal (affiliated to blue owl capital) has deep cooperation and interest relationship with NBA, NBA will charge management fees according to a certain proportion of its fund investment, and also draw them from the fund’s incentive income distribution.

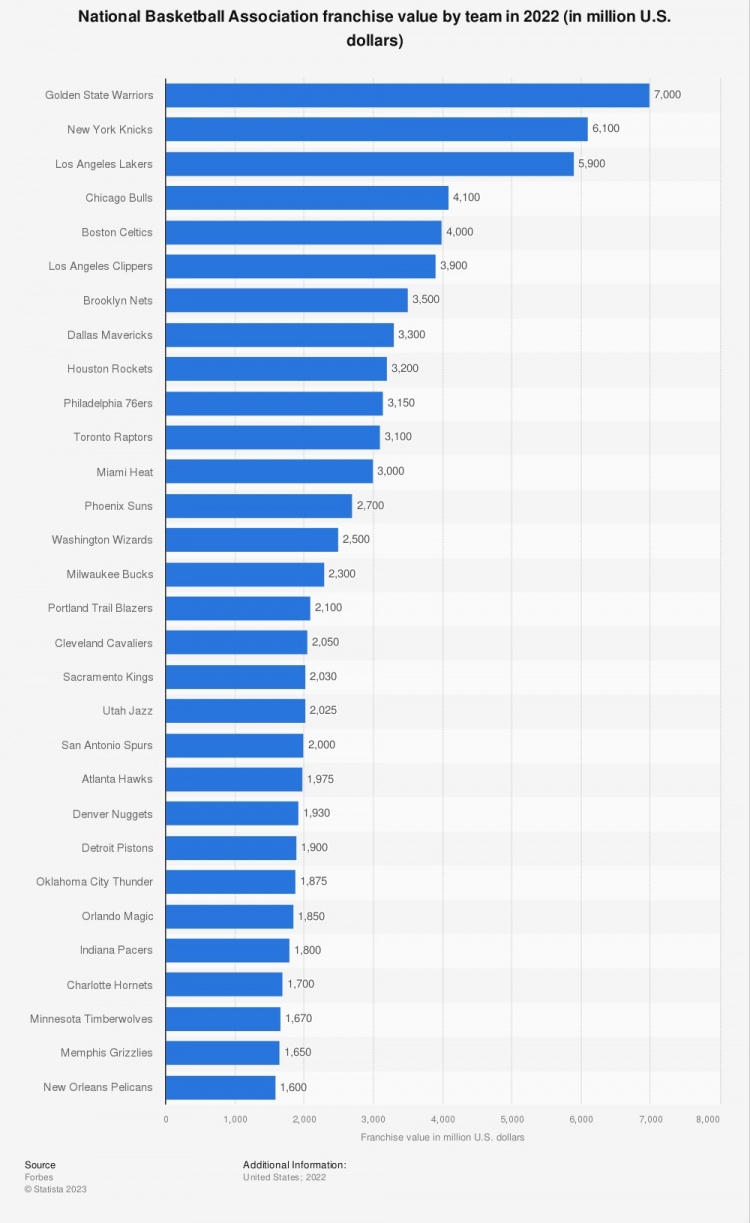

Dyal acquired less than 5 percent of the shares of Sun in 2021, which is calculated based on the valuation of 1.55 billion teams, with a total investment of about 77.5 million. Now we all know that the Sun sold at a record high price of 4 billion, and we can imagine how amazing the return rate of this investment is. It seems understandable that Jordan chose to cash out at a high level and sell the wasps at a high price of 3 billion.

The admission of private equity funds will further push up the market value of the team, such as the Knicks Lakers (although the probability of transfer or dilution of equity between Dolan and Bass families is close to zero) the transaction value has been horrible to unimaginable-last year, the purchase price of 27 percent of the Lakers’ equity has exceeded 5 billion.

An anonymous boss said, “the investment cycle of most funds is five to ten years, but NBA is different. Few equity holders really want to sell. NBA teams are always suitable for long-term investment. These funds will be held for 20 to 30 years, and their investors believe that the market value of the team will continue to rise.”

“Think about it, after 10 to 15 years, the market value of some teams may exceed 10 billion, 15 billion or even 20 billion,” said Andrew Polland, chief operating officer of Blue Owl Capital. “There are not many bosses who can reach this level.”

The NBA team valuation made by American media is also at the lowest level of one billion.

Because at present, the shareholders who acquire the majority of the team are basically composed of a consortium of up to 25 people. The entry of institutional investors can also allow NBA to limit the number of minority shareholders of each team and clean up the ownership structure, reduce a lot of trouble and confusion for big bosses who hold the right of clapping.

Those fund types that Americans know the truth and are stable can naturally rest assured, but foreign sovereign funds are different. Especially considering that the sovereign wealth fund, which is currently the largest in the world and also invests heavily in professional sports, belongs to PIF and QIA. The Middle East tyrants behind this have touched many sensitive nerves of the United States.

Qatar has always been famous for being rich in small countries. QIA was founded in 2005 with 450 billion assets under management, covering finance, industry and real estate, including London stock exchange, credit transfer, Barclays and Deutsche Bank, Volkswagen and Empire State Building. Not long ago, QIA also participated in Musk’s acquisition of Twitter, providing 0.375 billion funds for it. Qatar Sports Investments is a subsidiary of QIA and the sole owner of the greater Paris club.

Nasser Ben Ganim halifi, chairman of Qatar Sports Investment Company

The layout of investment in the United States is the top priority of QIA. It opened a New York office in 2015, waving tens of billions of dollars of checks with ambition. In Washington, its CityCenterDC development project has been put into construction, and the site is located near the home court of Wizards. While investing in the parent company of Wizards is nothing more than doing as the Romans do, and they want to rely on sports to get closer to the local core power circle.

PIF has a larger scale with a history of more than 40 years and more than 600 billion funds under management. However, it was not until 2014 that saudi crown prince mohammed ben salman became the actual controller that he began to be active in the world, from Boeing to Facebook to SoftBank to Disney and even game companies like Nintendo, PIF’s large investment can be seen.

The purpose of the global expansion of the sovereign funds of Qatar and Saudi Arabia is very realistic: everything is exhausted for oil wells (or the world gradually gets rid of its dependence on oil), create jobs and prepare for economic growth.

However, compared with QIA’s low-key efforts in Washington, PIF’s two major sports investments in Newcastle United and PGA have caused a lot of criticism and resistance.

At that time, 19 clubs in the Premier League boycotted against the acquisition of PIF; And the internal positions of PGA were also polarized. When PIF set up a Golf investment department and launched its own professional tour LIV Golf, hard to hit the money and rob people to fight against PGA. Many players still wavered in the face of nearly double the bonus. Some people also signed a 100 million-yuan sky-high contract, but benchmark figures like Tiger Woods, the opposition attitude was extremely fierce, and even rejected nearly 1 billion digger offers.

At the beginning, the chairman of PGA, Monahan (who once served as an executive in Fenway Sports Group, which was a sports capital giant with LeBlanc’s stake), also bounced on the angle-digging behavior of LIV, suggesting that players who see money will bear the “human rights stain” of the Saudi government, but after secretly reaching a merger agreement with LIV, he said: “I know someone will definitely scold I am hypocrites, but the plan is really unable to catch up with the change.”

Now Monahan has been scolded to resign, and the PGA, which was originally problematic at the operational level, has attracted both the US legislation (Senate Committee on Homeland Security and Government Affairs) and the administrative (Department of Justice) Department to investigate.

Monahan

The biggest apparent motive of the investigation-which can also be called as the motive in line with procedural justice-is anti-monopoly, because the merger of the two major events may lead to the reduction of matches and salary, thus damaging the interests of players and fans. At the same time, as a tax-free non-profit organization, PGA accepts foreign investment and lets PIF intervene in operation, which will certainly lead to doubts that foreign governments may directly benefit from the tax-free policy of the United States.

As for the motivation that is not so consistent with procedural justice, it is still related to political stance. This should start from the murder of kasuji in 2018. The fugitive journalist criticized Saudi Arabia and the Crown Prince many times and was mutilated and murdered in the Saudi consulate in Turkey, shocking the world. Although Ben Salman denied that he had ordered the killing, the confidential documents disclosed by the United States showed that the two private planes taken by the agent team who tortured kasugi belonged to the airlines under PIF.

In addition, PIF also has close ties with former US President Trump and his son-in-law Kushner. Trump not only maintained the crown prince in the casuji case, but also praised the merger of PGA and LIV recently. Just two years ago, PIF invested 2 billion yuan in Kushner’s newly established private equity company (a year later, the company’s total management funds were 2.5 billion, all relying on Saudi Arabia).

During the US presidential election in 2020, Biden once spurned the crown prince, saying that he must be isolated to the end. However, Biden’s attitude towards Saudi Arabia gradually softened when he was in office. Now it seems that his harsh words in those years were not so much a demonstration to the outside world as a pretext to fight against political enemies internally.

In contrast, Qatar did not encounter so many obstacles. Apart from the different attitudes of Americans towards the two countries, the most important thing was the issue of control.

NBA does not give QIA any control and does not allow it to participate in any operation and business decisions. Therefore, Qicai has a new shareholder and will not have any impact on the products on the NBA table, american fans don’t even have to bother to choose a position of resistance or support.

Excited welcome Saudi Arabia’s money-smashing Newcastle fans wearing headscarves cosplay has caused controversy

“If you want to run the league successfully, you must actively innovate,” said Ian Charles, founder of Arctos Sports Fund, who has gained nearly 70% of management assets in the past year and has already taken shares in four NBA teams. “Our job is to help NBA and its boss achieve growth innovation.”

As the NBA Butler, it is not easy for Xiao Hua to maintain the rapid growth and expansion of Stern era and possibly more important stability in the current unpredictable international situation.

But it is undeniable that in the last 20 years, the “financial (or capital) attribute” of professional sports “, perhaps it has obviously surpassed the” sports attribute “that determines its own definition in the hearts of the public-of course, for the bosses standing at the front desk of the capital, this may not matter at all, after all, this” game “and the” game “in” I love this game “may not be the same thing for a long time.

Welcome to our wechat public number “Houchang Village sports team” to see, there are more NBA, CBA related archaeology, comments and character content>>

(Text/kewell)